BlogGoldman Sachs Asset Management, L.P. and NextCapital Software, LLC are part of The Goldman Sachs Group, Inc. All information relating to periods before August 26th, 2022 shown herein are not from Goldman Sachs Asset Management, L.P. or The Goldman Sachs Group, Inc.

|

|

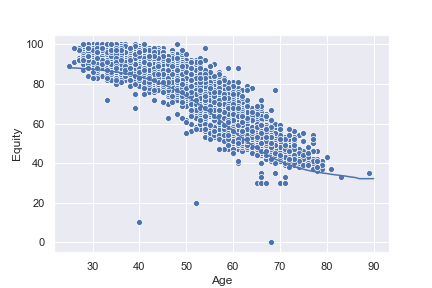

Target date funds (TDFs) aren’t sophisticated enough to address the retirement needs of American workers. There’s a rising tide of workers retiring, and many of those workers don’t feel ready for retirement. Now more than ever, investors need customized, cost-effective income planning and investment strategies. Personalized managed advice can meet that need by providing better outcomes for investors than they would get with TDFs. There are a number of benefits for firms that offer personalized, managed advice, too. First, let’s take a closer look at one way personalized advice provides better outcomes than TDFs. The solid line in the graph below shows the asset allocation distribution of one asset manager’s age-based TDF glide path. Compare this to the individual dots, which represent personalized glide paths. These personalized glide paths account for all the asset manager’s underlying inputs, like capital market assumptions, asset class views, etc. The graph shows how personalized managed advice proposes asset allocations that can differ from what investors would get from a TDF. This is because personalized managed advice considers a number of characteristics for each individual investor, while TDFs only consider an investor’s anticipated retirement year. With personalized managed advice, however, each investor receives a customized portfolio that accounts for other important details, like marital status and overall health.

Personalized managed advice also has benefits beyond personalized asset allocations. Some of these benefits include:

It also comes with opportunities to engage investors and provide them with further education. 60% of investors say they need better education about retirement planning, and TDFs aren’t well equipped to address that need, either. Personalized managed advice, on the other hand, provides investors with a plan that gives them a roadmap with concrete recommendations to help them reach their retirement goals. Better outcomes aren’t just for investors. The technology that transforms TDFs into personalized managed advice can be used to deploy advice, too. Entire plan populations can be enrolled in bulk, for example. Trade instructions and confirmations can be automated, too. This technology has other benefits beyond deployment. A solution that offers personalized managed advice—like NextCapital’s—can account for a plan’s defined contribution account types and restrictions. It can consider savings rules, employer match rules, and auto-escalation. And for IRA plans, it can automate and manage rollovers, partial withdrawals, distribution schedules, and restricted positions. Multiple leading asset management firms have already transformed TDFs into personalized managed advice by partnering with NextCapital. These firms are now rolling out solutions that help provide better retirement outcomes and education for investors, and they benefit from technology that lets them more efficiently offer comprehensive, personalized retirement planning and advice. The information provided by NextCapital Group, Inc., (“NextCapital”) including its wholly owned subsidiaries, NextCapital Software, Inc. (“NextCapital Software”) and NextCapital Advisers, Inc. (“NextCapital Advisers”) is educational only and is not investment or tax advice. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and NextCapital Advisers charges and expenses. NextCapital Software and/or NextCapital Advisers’ internet-based services are designed to assist clients in achieving discrete financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and may not incorporate specific investments that clients hold elsewhere. For more details, see NextCapital Advisers’ Form ADV Part 2 and other disclosures. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where NextCapital Advisers is not registered. This website is operated by NextCapital Group, Inc. NextCapital Advisers, Inc. is registered as an investment adviser with the Securities and Exchange Commission. Unless otherwise specified, any return figures shown are for illustrative purposes only, and are not actual customer or model returns. Actual returns will vary greatly and depend on personal and market circumstances. Comments are closed.

|

RSS Feed

RSS Feed